JobKeeper 2.0 – What it really means

So the Morrison government gave a sneak peak at what JobKeeper 2.0 will look like from October 2020, and whilst most people are losing their minds, there are some good changes coming.

So the Morrison government gave a sneak peak at what JobKeeper 2.0 will look like from October 2020, and whilst most people are losing their minds, there are some good changes coming.

How will you be impacted? What should you be doing now? And how can you prepare for life “post JobKeeper”?

Well first and foremost, JobKeeper 2.0 is not legislation yet so we can’t tell you the exact impact as things could (and most likely will) change. Until the legislation is passed we won’t know the nitty gritty details or if there will be any new alternative turnover tests. And those nitty gritty details are absolutely vital. Those details will prove the difference between business owners being eligible and rightfully claiming JobKeeper. And business owners not being eligible and potentially having to pay back thousands of dollars. Which will be a total shit fight in the current economic climate.

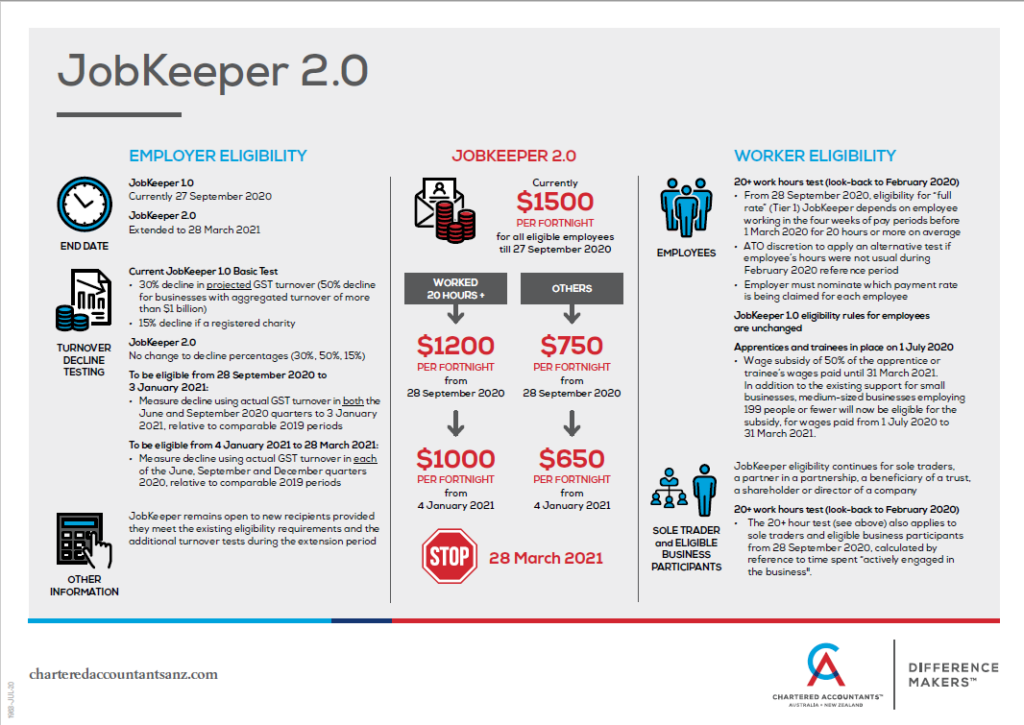

So what exactly do we know about JobKeeper 2.0? Firstly, the rules are much more stringent in Round 2, however note nothing changes until after September 2020. If you are currently an eligible business with either eligible employees or an eligible business participant, you will continue to receive JobKeeper until 27th of September. Please note the September payment will be made once you do the monthly reporting in October.

The criteria to be eligible in JobKeeper 2.0 is the real kicker – you need to face a downturn of 30% or more in the June 2020 quarter v last year AND the September 2020 quarter v last year to be eligible. With further testing to be done to see if business owners then qualify for the March 2021 quarter.

We know most small business owners worked their bloody arses off in May and June to try and recover from a pretty shitty start to this year, and this hard work could in fact see them out of the running for further JobKeeper payments after 27th September, regardless of how their business performs from now onwards.

However, please keep in mind that you have potentially had 6 months of government assistance, and sometimes those payments may have been received in months you didn’t have a downturn. So we should be thankful we live in a country that has been able to provide this support. We know for many that the amount received via JobKeeper is not enough, but there are many countries out there who are impacted during this Pandemic with very little financial assistance. So in tough times, we still need to be grateful on some levels.

The amounts are also changing both in the December 2020 quarter and the March 2021 quarter. And in some cases I think this is brilliant. We have had so many part time and casual employees (not within the HBF team of course) decide they much prefer to stay at home and not work and be entitled to JobKeeper. This put massive pressure on employers, and often they had to hire new staff who were not entitled to JobKeeper to cover the shifts. This in turn costs the employer extra money so they are going backwards just to try and keep people employed. So I am hoping the lower rate will encourage people to actually work their designated hours and not be paid a “top up” for hours that are not being utilised by the employer. Well I can only hope so!

So my advice is you need to start planning for October and beyond now. Like right now. What does your workforce look like, what does your rostering look like, what will your wage payments look like, and how will that be sustained, what does your income streams look like and what cuts do you need to make. Do you need new employment contracts, do you need to change staff allocation – work ALL of that out before crunch time hits. These should not just be “overnight, fly by the seat of your pants” decisions.

I want to give you some insight into JobKeeper Round 1 for us:

- Our team did a combined total of over 100 hours of unbillable webinars, training and workshops so that we could be across the rules and regulations

- We have already starting doing more webinars and training for JobKeeper 2.0 and September is still 7 weeks away

- We had people accuse us of profiting from JobKeeper as we charged a very small fee to do the monthly reporting (um…see above unbillable hours spent !)

- We have close to 50 clients enrolled in JobKeeper (that is not a great achievement, it means over half our client base have been heavily impacted by the pandemic and face potential permanent closure)

- At one stage I considered closing HBF as I went a full month without paying myself a wage and I had 72 invoices outstanding, all whilst paying my staff in advance for JobKeeper topups

- There was one day where I had to phone 5 clients in a row and all had closed down. I got off the last call and sat in the shower and cried, the emotional toll was just massive

- During JobKeeper and remote learning I didn’t get to bed before midnight for 8 weeks straight just so I could keep up with client phone calls, emails, texts, messages, calculations, training and everything else

I am going to be perfectly blunt – JobKeeper round one has been a total ball breaker, on all levels. Emotional, financial, mental, family relationships were severely tested and everything in between.

For clients wishing for us to assess their eligibility for JobKeeper Round 2 – we will be implementing a fee to do so. I am not sure what the fee is yet, as we are in #EOFYhell right now. That fee will cover our time, experience and knowledge to get the application right. As getting it wrong, could mean repaying JobKeeper and not being eligible for future government assistance. Something we simply won’t cut corners on or willing to “fudge” to get people over the line.

We have attached an infographic below from Chartered Accountants, which gives a great summary of the JobKeeper changes announced this week. Please keep in mind that until legislation is passed, changes can still arise, but this is as it stands for now.

We will keep our finger on the pulse on your behalf …but please be patient. Our end of financial year workload is totally crazy and ensuring we meet ATO deadlines for clients is our main focus right now.